NM APARTMENT

1 9 8 9

REPORT

1 9 9 8

"Market Forecast '99 - Rents"

Originally appeared inNM Apartment Report

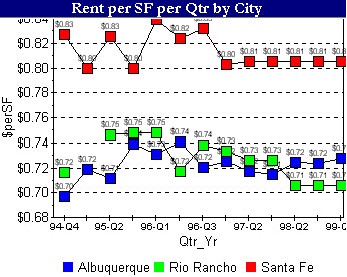

The graph to the left indicates rent levels on a per square foot basis for Albuquerque, Rio Rancho and Santa Fe. Santa Fes recent construction growth, has allowed the market to expand rent levels, which have now stabilized at $.82 per square foot.

Rio Rancho, a sub-market with less than 1,000 units has experienced a downturn in rental growth related to new construction and the layoff and/or closings of several large employment firms.

After the 1989-1994 boom that allowed Albuquerque to raise rents from $.49/sf to $.72/sf , rent growth has fluctuated less than 4% and today stands at the 1994 levels.

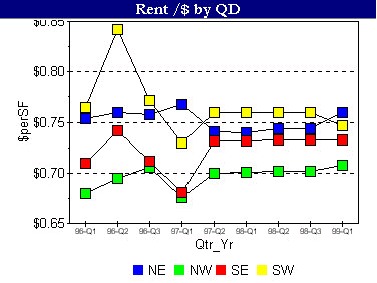

Albuquerque by QD

The SW Quadrant, home to less than 2,000 units has remained fairly stable, with the exception of one large new community - Bridge Point (a tax credit deal). After taking a beating for three consecutive quarters, the SE Heights is showing signs of recovery and has stabilized rent levels of $.72/sf

The every expanding NW heights is also showing modest expansion with rent levels increasing to $.71/sf.

The highly sought after NE Heights turned the corner after four consecutive quarters of depressed rent levels (below $.75/sf) with a recent rental increase to $.76/sf.

Albuquerque by Grade

This layered graph indicates what common sense dictates - the higher the grade of the property, the more rent per month that community will collect. For the most part, each of the grades has followed each other through increasing and decreasing rent cycles. One notable exception is the concession wave that impacted A and B product between 95Q1 to 97Q1, a two year roller coaster period as communities struggled to maintain a stabilized occupancy level.

1

Article by

by Todd Clarke CCIM (www.nmcomreal.com/nmcomreal)

p a g e

o n e