NM APARTMENT

1 9 8 9

REPORT

1 9 9 8

"1998 - Q2 - Sales/Occupancy/Rent Update"

Originally appeared inNew Mexico Apartment Fax

As you know, the NM Apartment Report surveys over 77,000 apartments units every 90 days on their current occupancy and rent levels. This grueling process involves over 1,000 phone calls and a ten megabytes of data entry. Needless to say, the college students who intern for this two week period rarely last the entire time (Kudo's to Jennifer Malloy - a Berkeley student who made all the phone calls and obtained one of the highest feedback ratings for the surveys.)

Why do we make the phone calls? To provide our customers with accurate information and as a service to the marketplace so that all parties can deal with a consistent, accurate, market information.

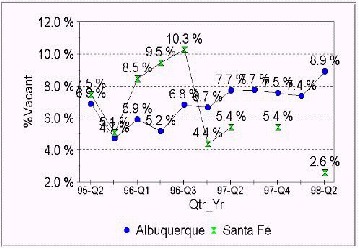

Vacancy

Albuquerque's physical vacancy rate continues to climb to 8.9%, while economic vacancy fluctuates between 11% to 15%. Broken down by quadrants, the SW quadrant (also the smallest submarket) is reporting a vacancy factor of 13%, while the NE Heights has retaken its crown as the lowest submarket at 9%. The last graph on Page 2 demonstrates that the "A+" grade apartments are leading with a vacancy rate of less than 3%, while the "C" to "B+" grade communities are hardest hit with a vacancy rate in excess of 10%.

Santa Fe's vacancy continues to decline to its current level of 2.6%, down from its previous level of 5.6%. Given its smaller market size, Santa Fe has a tendency to absorb its newly constructed units much faster than Albuquerque, and is most likely least subject to "tenant leakage" to inexpensive single family residences or manufactured homes.

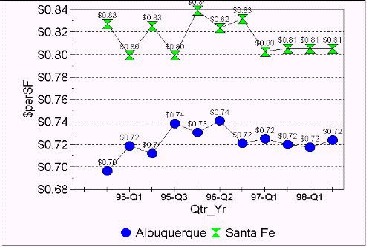

Rental Rates

For the fifth straight quarter, the average rent per square foot in the Albuquerque Metro Area is hovering at $.72 per square foot. Since its increase from the 1994 level of $.70/sf, and a brief increase to $.74/sf shortly thereafter, rent levels have remained unchanged for four years. Please note that this is quoted market rent and that most likely economic rent levels have decreased to $.70/sf once rental concessions are taken into account.

For the last four years, Santa Fe's rent levels have averaged $.81/sf, with seasonal fluctuations between $.80/sf to $.83 per square foot. Give the impact of tourism and the government sessions, Santa Fe's seasonal fluctuations have been an ongoing trend for over a decade.

Sales

Over the last year, I have been bemoaning the impact that an inflated stock market was having on alternative investments, and the above graph confirms the tapering off of the volume of smaller apartment transactions for the last three years (although the $/unit has remained fairly constant). Twice this year the Dow Jones Industrial average has made a "correction" (don't you love that term - if we lost equity in an apartment - it would be worth less - and would not be called anything I could publish here!) below the 9% level. The first time was the last week of January and the second has most recently been felt since early September. During both those times the frequency of phone calls had increased exponentially and the number of sales has also increased. My own listing inventory of some 45 different communities totaling over 1,000 units currently has 70% of the units under contract, most of which has occurred in the last three weeks.

Look for this trend to continue well into the first quarter of 1999.

IF YOU ARE A SUBSCRIBER - PLEASE LOOK FOR THIS MONTHs NEWSLETTER IN THE MAIL. I THOUGH THE COLOR GRAPHS WOULD BE DIFFICULT TO READ VIA FAX.

Article by

by Todd Clarke CCIM (www.nmcomreal.com/nmcomreal)

p a g e

o n e