NM APARTMENT

1 9 8 9

REPORT

1 9 9 8

"A WORD ABOUT THE MARKET"

Originally appeared inNew Mexico Apartment Report Vol. 5.2 - Q2’98

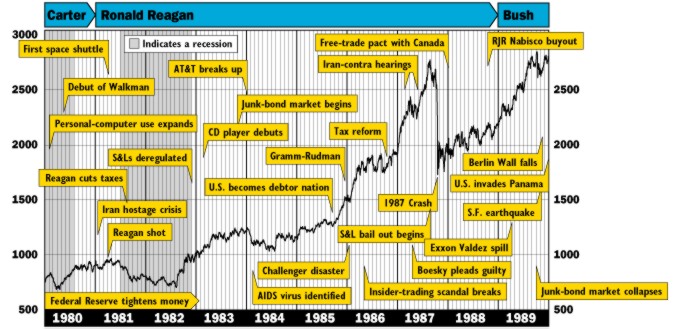

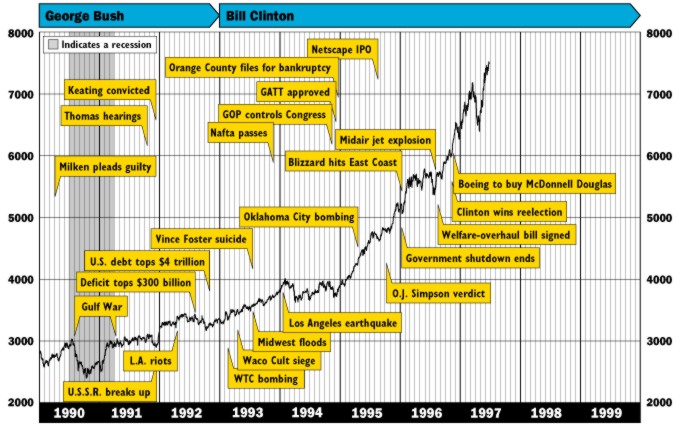

For the last 36 months, the buzz has been over the stock market. Granted, returns have been phenomenal, and market analysts are quick to point out the rapid appreciation in the Dow Jones. But a word of thought - can the increase in values be attributed more to improving business efficiencies, or a change in the standard of measure?

As you know, one standard used to measure the performance of apartments is the Gross Rent Multiplier (GRM). This multiplier can be calculated by dividing the purchase price by the annual gross income. Typical ranges for NM Apartments are 4 to 9 times annual earnings. Thus if an apartment's gross income is $100,000 then it might be worth $400,000 to $900,000, depending on age, condition, location and other objective factors. If a property did not have any expenses, the GRM would determine how many years it would take for the community to pay for itself, thus the lower the GRM, the better the deal.

Stocks have a similar measurement, known as the Price to Earnings (P/E) Ratio. This ratio is calculated similar to the GRM. Unlike the imperfect real estate market, the stock market's liquidity allows the P/E ratio to fluctuate dramatically from the 10-12 range a few years ago to the 24-27 range today.

Could we expect the same from the apartment market as we do the stock market? Although the level of investor interest is increasing, unlike stocks, investors expect cash flow and appreciation from their real estate investments.

So although a substantial increase in investment from investors could force the GRM up, one would not expect the dramatic swings that the stock market experiences.

Article by

by Todd Clarke CCIM (www.nmcomreal.com/nmcomreal)

p a g e

o n e